Sustainability Management

Aozora’s Basic Approach to Sustainability Promotion

Through communications with our stakeholders, we will use our imagination in identifying current and future issues,

and continue to take on the challenge of achieving both economic and social value

Governance

Sustainability Promotion System

Under the supervision of the Board of Directors, Aozora has established a sustainability promotion system led by the Sustainability Committee to advance sustainability initiatives that are integrated with its overall management strategy.

The Board of Directors, which is composed of directors with diverse backgrounds, including those with expertise and experience related to sustainability, resolves matters regarding the setting and reviewing of Aozora’s Sustainability Targets, which are management goals centered on Aozora’s focus areas, and regularly reviews the status of their progress.

The status of progress and achievement of Aozora’s Sustainability Targets is considered an important qualitative factor in determining their remuneration.

Main agenda of the Sustainability Committee and Liaison Meeting of Group Sustainability in FY2023

|

Sustainability |

Liaison Meeting of Group |

|

|---|---|---|

|

Members |

CEO (Chairperson) |

Executive Officer in charge of Sustainability Management (Chairperson) |

|

Number of meetings held |

8 |

4 |

|

Main agenda items |

|

(In addition to sharing information on the matters listed on the left with group companies)

|

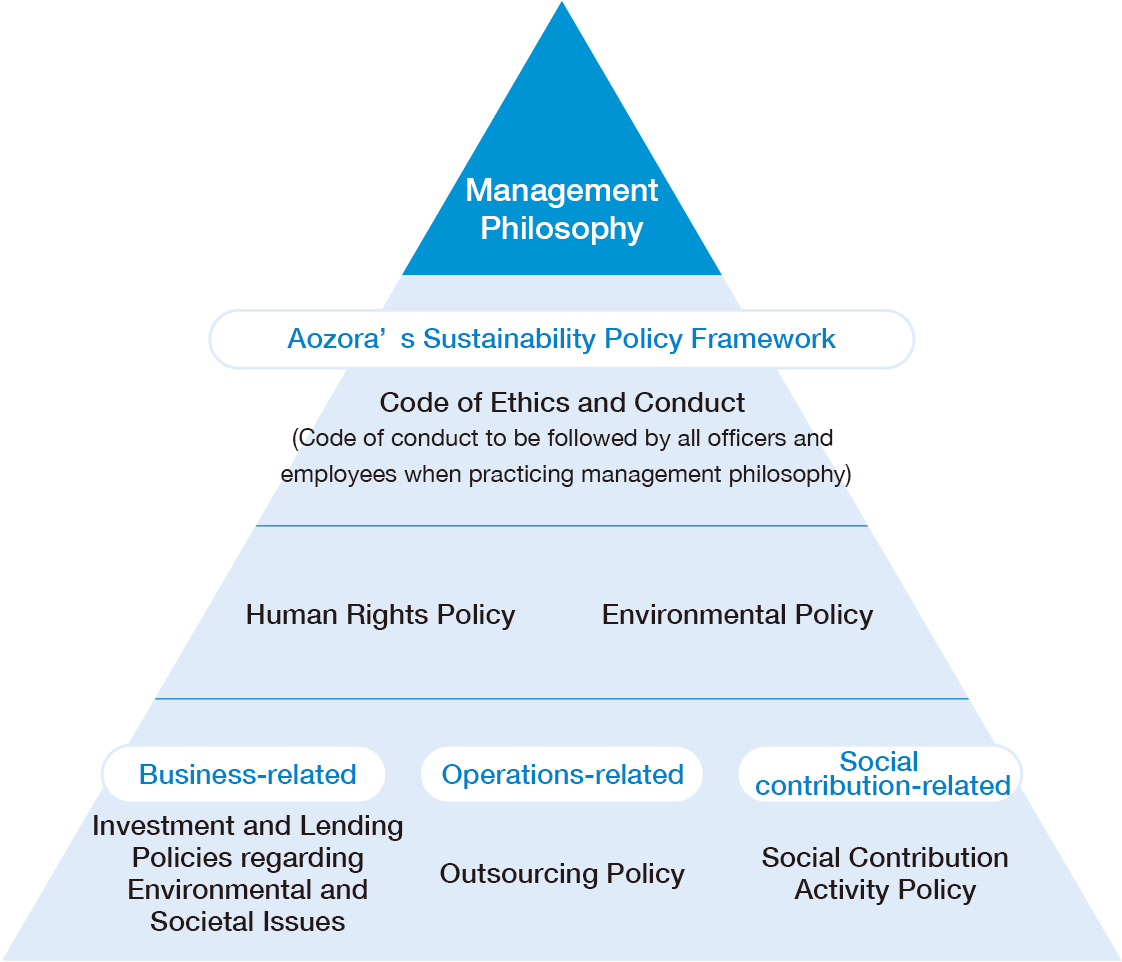

Sustainability Policy Framework

We have established sustainability-related policies, including our Human Rights Policy and Environmental Policy, based on the Code of Ethics and Conduct, which is a code of conduct to implement our management philosophy.

Initiatives Taken in FY2023

- Revised our Human Rights Policy and Environmental Policy in consideration of response to international standards and moves to clarify responsibilities in supply chains

- Revised Investment and Lending Policies regarding Environmental and Societal Issues from the perspectives of engaging in transition finance, respect for human rights, and preserving biodiversity

- Established the Social Contribution Activity Policy to clarify the significance and positioning of donations, volunteer activities, and other social contribution activities of the Group

We will continue to review these policies as needed in the future in response to trends in society.

Strategy

Key Sustainability Issues (Materiality)

In this context, Aozora defines Materiality as “issues we should focus on to realize our management philosophy, based on social trends and stakeholder expectations and demands, as well as their importance in regard to corporate management across the Group.”

Aozora has selected as its Materiality issues “response to climate change” and “respect for human rights” to address global issues on a worldwide basis; “promoting industrial transition,” “expanding corporations’ access to financial services,” “promoting DX,” and “business and asset formation, transfer to the next generation” to create social and economic value through focus businesses; and “governance/compliance” and “improving sustainability of human capital” as the management foundation essential for Aozora’s sustainability.

Aozora will continue to flexibly review Materiality issues in response to changes in the business environment while building a PDCA cycle that is integrated with our management strategy, and will steadily promote Group-wide efforts to resolve issues.

Aozora’s ESG Support Framework

Aozora provides both financial and non-financial solutions to support customers’ initiatives to solve environmental, social, governance and other sustainability issues through the Aozora’s ESG Support Framework.

Promoting Sustainable Finance

Aozora has set the goal of sustainable financing at 1 trillion yen (including environmental financing of 700 billion yen) by FY2027 (for seven years) as part of Aozora’s Sustainability Targets.

Risk Management

Risk Appetite Framework / Key Risks

We have established a Risk Appetite Framework to appropriately manage risk toward achieving business strategies and financial plans, and to enhance corporate value in a sustainable way.

In addition, we have established an integrated risk management framework that categorizes risk by risk factors including credit risk, market risk, liquidity risk, and operational risk, and manage risk according to each risk characteristic to identify, evaluate, and control risk overall.

When recognizing key risks, risks related to sustainability are incorporated into each key risk category and used in discussions for business plans by the Board of Directors, Management Committee, and Sustainability Committee. We have specifically identified the following as risks related to sustainability.

- Increase in credit costs: Decline in the corporate value of our investment and loan portfolio companies due to delayed response to climate change or respect for human rights

- Delays in Aozora’s structural transition or business model conversion: Higher foreign currency funding costs and loss of sustainable financing opportunities due to lower ESG ratings from an external evaluation of being negative about our sustainability promotion.

Investment and Lending Policies regarding Environmental and Societal Issues

Regarding issues that may have a negative impact on the environment or on society, we have established Investment and Lending Policies regarding Environmental and Societal Issues that outline policies for “cross-sectoral” and “specific sector,” and prohibit or discourage investments and lending to companies or projects that may have a negative impact. The Policies are also intended to reduce the risk of transactions with companies that have social issues such as environmental and human rights concerns and do not take appropriate actions in consideration of stakeholder expectations.

Polices Regarding Financing to Sectors That May Have a Negative Impact on the Environment or Society

|

Cross-sectoral |

Credit prohibited |

Businesses subject to the prohibition of financing through investments and loans |

|---|---|---|

|

||

|

Credit that requires close attention |

|

|

|

Project finance (Equator Principles) |

When considering providing financing or project finance advisory services for projects which fall into the scope of the Equator Principles, Aozora will verify the customer’s adherence to the requirements set out in the Principles. |

|

|

Specific sector |

Coal-fired power generation |

Aozora will decline to provide financing for the construction of new coal-fired power plants or expansion of coal-fired power generation facilities. Meanwhile, Aozora will proactively provide investments and loans to support its customers’ initiatives that contribute to the transition to a decarbonized society, including carbon dioxide capture, usage, and storage technologies. |

|

Coal mining |

When considering making investments or loans for the development of a new coal mine, Aozora will confirm the customer’s implementation of initiatives that take into account environmental and social issues. Aozora will decline to make an investment or loan for mountaintop removal (MTR) coal mining which has a substantial impact on the environment as well as for the development of new coal mines that supply power generation operators with coal. |

|

|

Oil and gas |

When considering making investments or loans for oil sands, shale oil and gas, oil and gas pipelines, and development in the Arctic Circle (the area 66°33’ north of the Equator), Aozora will confirm the customer’s implementation of initiatives that take into account environmental and social issues. |

|

|

Large-scale hydroelectric power generation |

When considering making investments or loans for new large-scale hydroelectric power generation (with an embankment of 15 meters or higher, as well as output of 30,000KW or above), Aozora will confirm the customer’s implementation of initiatives that take into account environmental and social issues. |

|

|

Biomass power generation |

When considering making investments or loans for biomass power generation, Aozora will confirm the customer’s implementation of initiatives that take into account environmental and social issues such as the measures to mitigate greenhouse gas emissions for the entire life cycle. In the case of woody biomass power generation, Aozora will also confirm the customer’s implementation of initiatives that take into account environmental and social issues, including combustion materials. |

|

|

Deforestation |

When considering making investments or loans for businesses involved in deforestation for the purpose of producing timber, paper, pulp, etc., Aozora will confirm the customer’s implementation of initiatives that take into account environmental and social issues. |

|

|

Palm oil |

When providing investments or loans for the development of palm oil plantations, Aozora requests its customers to disclose their compliance with NDPE (No Deforestation, No Peat, No Exploitation). When considering making investments or loans for businesses associated mainly with the distribution of palm oil, Aozora will confirm the customer’s implementation of initiatives that take into account environmental and social issues, including whether it has obtained RSPO (Roundtable on Sustainable Palm Oil) certification. |

|

|

Tobacco manufacturing |

When considering making investments or loans for tobacco manufacturing, Aozora will confirm the customer’s implementation of initiatives that take into account environmental and social issues regarding child and forced labor and health hazards. |

|

|

Inhumane weapons |

Aozora will decline to make an investment or loan for the manufacturing of inhumane weapons such as cluster munitions. |

|

|

Nuclear power, plastics, shipping, mines |

When considering making investments or loans for businesses related to these sectors, Aozora will gather information regarding the customer’s implementation of, and stance on, initiatives that take into account environmental and social issues. |

|

Aozora’s Structure for Implementing Environment/Society-focused Investments and Loans

In accordance with the investment and lending policies approved by the Management Committee, the Aozora Group reviews all investment/loan transactions to assess any risk to or negative impact on the environment and society. If a risk or negative impact is identified, the transaction is screened in terms of risk/impact severity as well as the customer’s efforts to resolve corresponding environmental and social issues, and then submitted to the Credit Committee or the Investment Committee for their approval.

Aozora supports its business divisions and branch offices in gathering information regarding customers’ consideration of and stance on addressing environmental and social issues by presenting a prepared checklist and sharing specific cases internally.

Metrics and Targets

Aozora’s Sustainability Targets

We have announced the establishment of Aozora’s Sustainability Targets aimed at creating economic and social value and shared across the entire Group.

Aozora’s Sustainability Targets are comprised of four categories, including promoting Aozora’s Strategic Investments Business and response to climate change. We have set medium- to long-term numerical targets centered on Aozora’s focus areas and commit to contributing sustainably to the environment and society.