Aozora’s Sustainability Targets

In September 2021, the Aozora Group announced the establishment of Aozora’s Sustainability Targets as long-term business targets aimed at creating economic and social value.

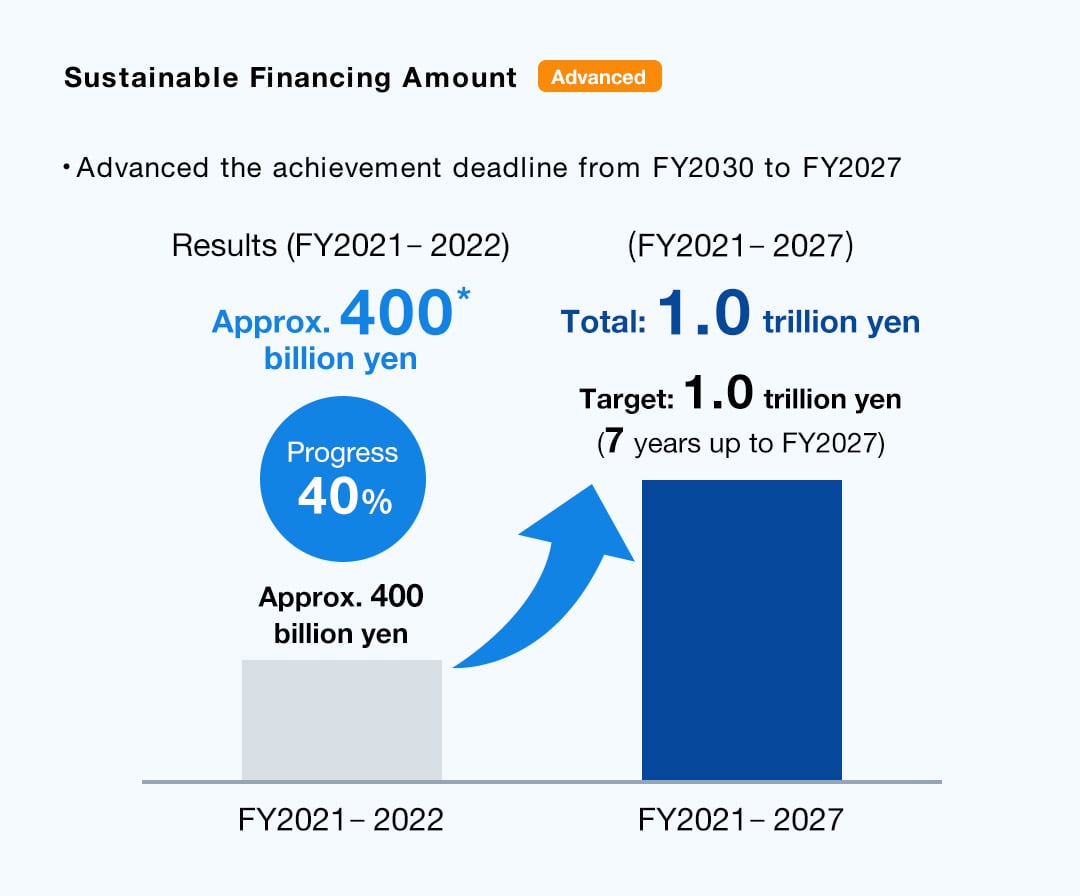

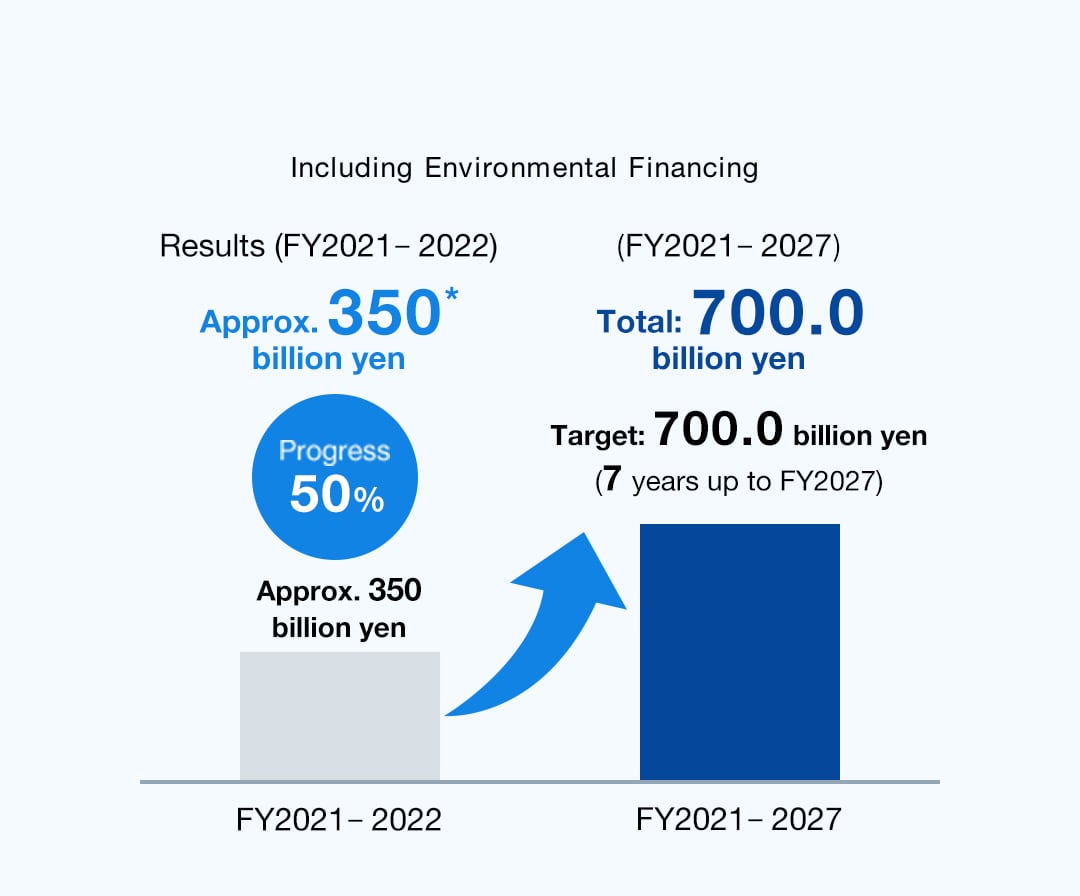

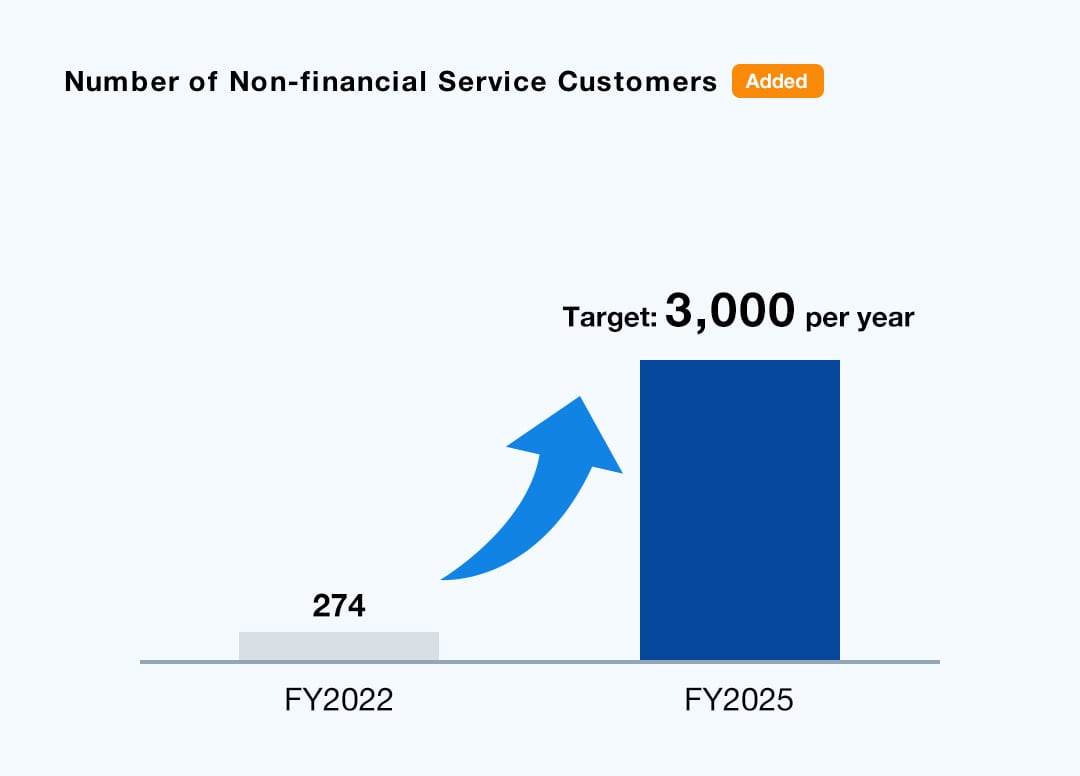

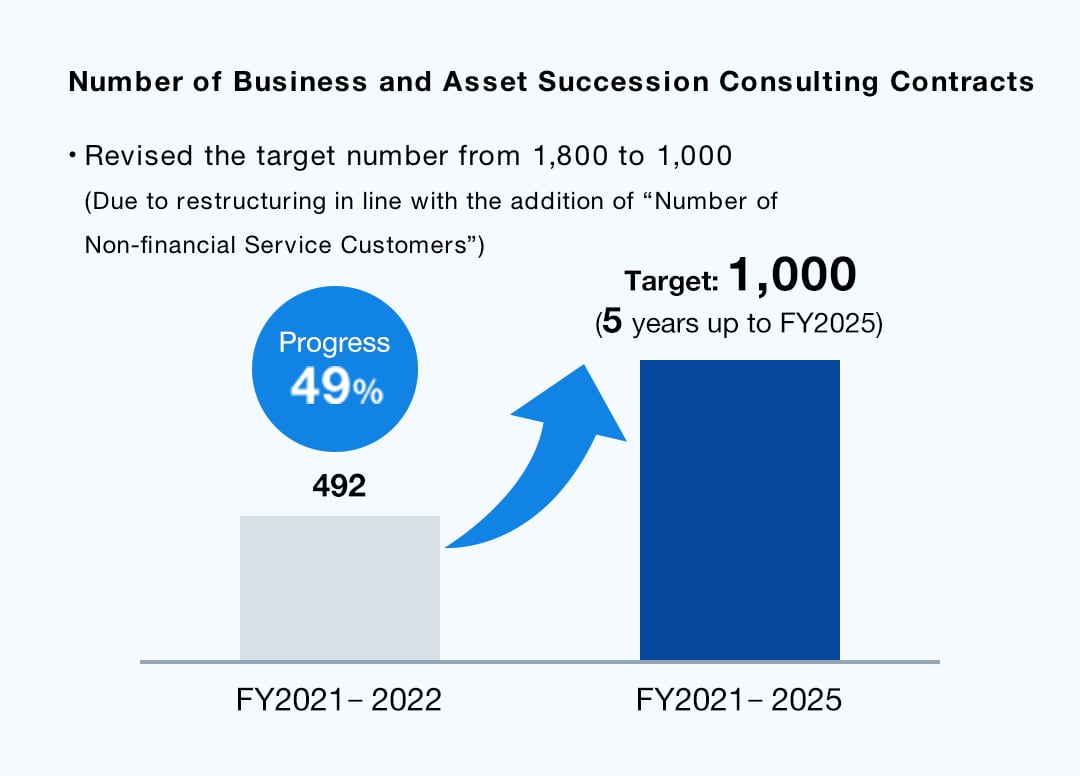

In conjunction with the formulation of the new Mid-term Plan “Aozora 2025,” the Aozora Group conducted a reevaluation of these targets, made a commitment to becoming carbon neutral including its investment and loan portfolio, raised the level of targets as well as advanced the achievement deadline related to Aozora’s Strategic Investments Business, and created additional targets.

The Aozora Group will promote Group-wide efforts to achieve these targets.

The progress and achievement of these targets are taken into consideration as key qualitative assessments in determining the evaluation and remuneration of executive officers.

Progress of Aozora’s Sustainability Targets (FY2022 Results)

1. Promoting Aozora’s Strategic Investments Business

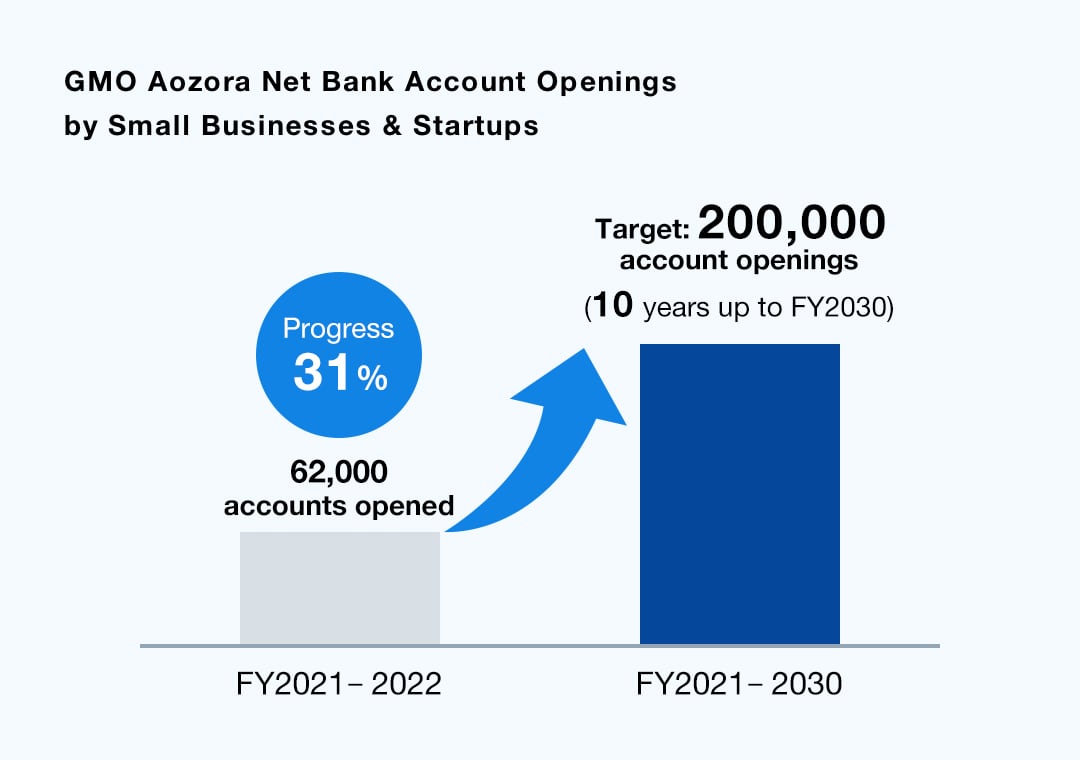

Expanding Corporations’ Access to Financial Services (Business Recovery / Start-ups)

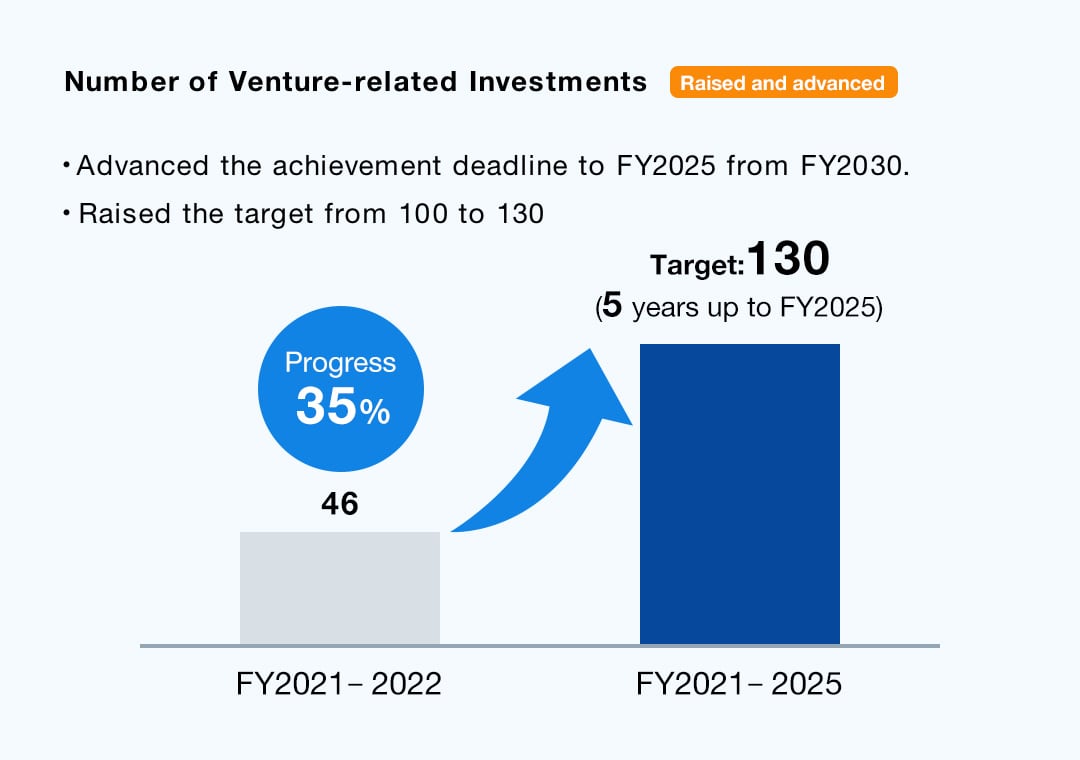

Growth Support for Venture Companies

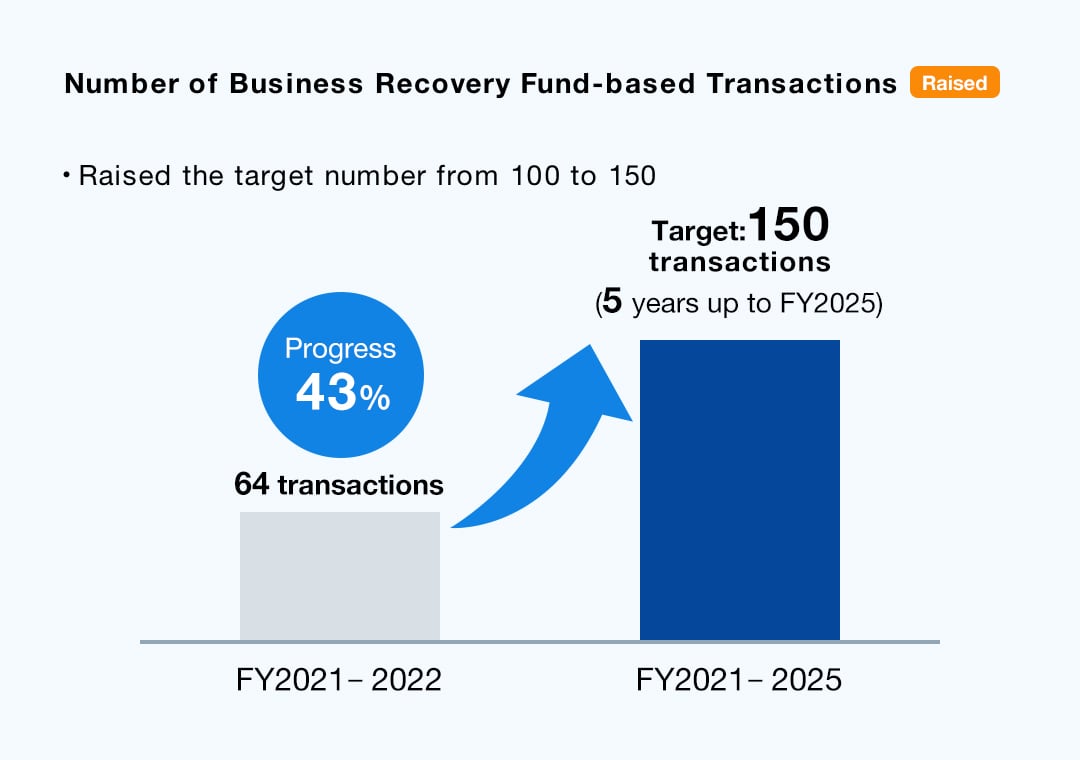

Contributing to Regional Communities through Business Recovery

Promoting Industrial Transition

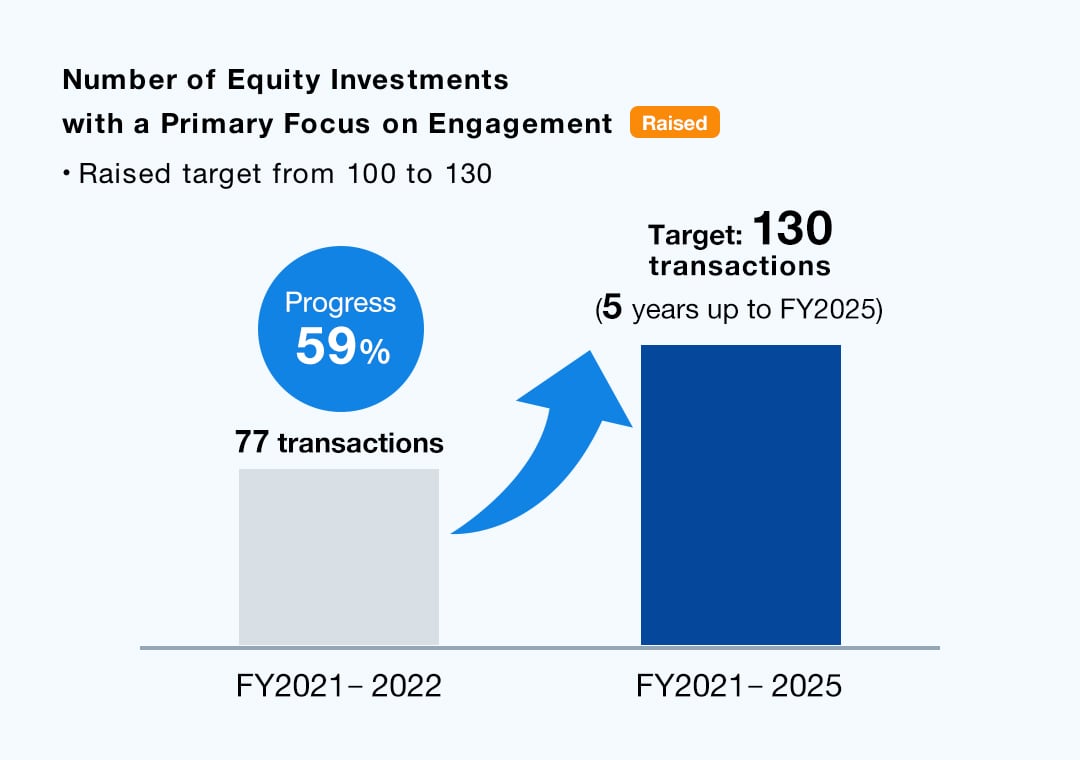

Equity Investments with a Primary Focus on Engagement Aimed at Structural Transformation

2. Response to Climate Change

Response to Climate Change

- The amount above does not include results from GMO Aozora Net Bank.

Achieving Carbon Neutrality

-

-

・Advanced the achievement deadline to FY2030 from FY2050

-

FY2022 Results

4,373 t-CO₂

(31% reduction from FY2020)

-

By FY2030

Net zero

-

-

-

FY2022 Results

Refer to “Response to TCFD Recommendations”

-

By FY2050

Net zero

-

-

Amount of Project Financing for Coal-fired Power Plants

-

As of March 31, 2023

27.5 billion yen

-

By FY2040

zero balance

-

3. Retail Customer Platform

Business/Asset Formation, Business Succession/Wealth Transfer to the Next Generation

4. Diversity & Inclusion (Diversity of Core Personnel)

Improving Sustainability of Human Capital

-

-

As of March 31, 2023

13.3%

-

By FY2027

20%

(25% in the medium to long term)

-

-

As of March 31, 2023

37.3%

-

By FY2027

40%

-

-

As of March 31, 2023

91%

-

By FY2027

100%

-

-

As of March 31, 2023

2.8%

-

Constantly

Maintain 3% or higher

-

-

As of March 31, 2023

49.6%

-

Constantly

Maintain 40% or higher